The lighting service industry is sitting in the driver’s seat to unlock a $44 billion nascent market opportunity in the United States for light-emitting diode (LED) lighting retrofits enabled by smart controls. LED lighting is the go-to solution for new construction thanks to superior performance and compelling lifecycle economics. In fact, a Goldman Sachs report called the rapid adoption of LEDs “one of the fastest technology shifts in human history.”

But in spite of this torrential uptake in new commercial construction and the residential sector, adoption in existing commercial buildings has been slow— hindered by owner and investor constraints and split incentives that are also attributable to the slow growth in commercial building performance upgrades or more broadly: lack of the right kind of funding to pay for improvements. It’s a common problem that building owners want the benefits of improved lighting, but want to only pay for it from operational savings to align with the benefit flows and not to deploy their own scarce capital. The result is a massive backlog of untapped opportunity to deliver higher-performing, more valuable and higher-tech buildings.

When one door closes another opens. In this case, a new business model, lumens as a service (LaaS), can unlock this backlog of opportunity with the winning combination of LED lighting plus smart controls. When offered by savvy service providers, this third-party ownership business model can expand revenue streams and establish competitive advantage.

What is LaaS?

Advancements in smart controls allow the remote monitoring, management and control of LED lighting, making it possible to vault the traditional asset-based ownership model of building equipment and separate the ownership of the asset (in this case, the lights) with the service they provide (the lumens).

In an “as a service” business model, a customer purchases a service (or subscription) from a service provider who then delivers that service as a fixed price per unit-of-output through assets that the service provider installs, maintains and improves.

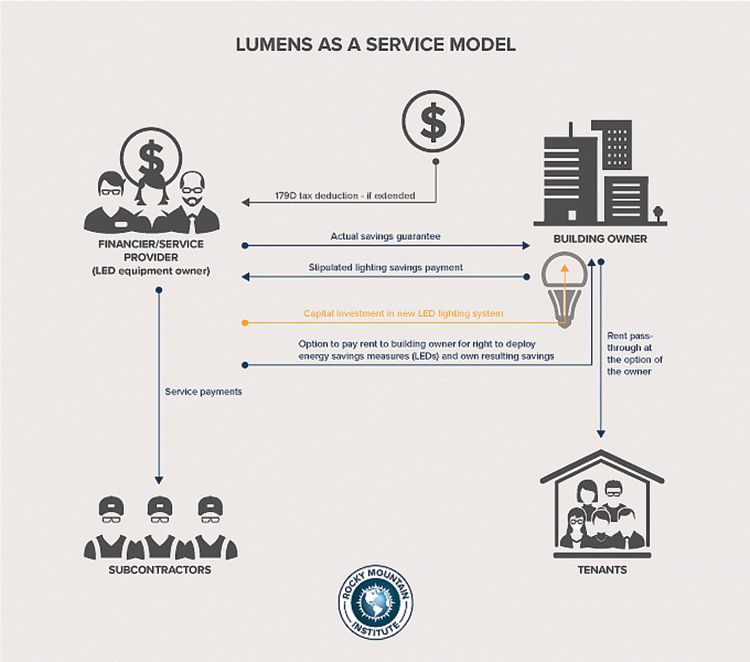

In a LaaS model, a commercial building customer specifies its required lighting outcomes, and a service provider then delivers the contracted lighting service by designing, installing and maintaining a system designed to meet these outcomes. In addition—depending on the agreement’s term length—savings from the new LED system can cover the service costs of that system (i.e. financing plus ongoing maintenance) and any monies left over can then be shared with the client, or—if the client prefers—alternately converted to a fixed rental payment for the term of the service agreement.

This model changes the game in LED investment because its structure appropriately shifts the investment off of the building’s balance sheet and creates a win-win-win for landlords, tenants and service providers.

Third-Party Ownership Models Have Heralded Industry Transformation

While LED retrofits are a novel application for the “as a service” model, it is far from a new idea altogether.

Consider your office copy machine. You use it, but when it breaks someone else comes to fix it. Every once in a while, it gets swapped out for a better one. You pay little attention to the machine, focusing only on what it provides to you: faxes, printouts or paper jams. More often than not, your company doesn’t actually own this machine. Instead, it is owned by a company like Xerox, which has a service contract with your company based on your needs (e.g., number of copies each month). This copying as a service model is good for the customer, who doesn’t need to budget for the capital associated with a copy machine (and anticipate use over the life of the asset) and good for the service provider, who can balance assets across multiple customers.

Some of the biggest shifts in the transition to clean and renewable energy, including the rise of ride-hailing services such as Uber and Lyft and the boom in residential solar photovoltaics, are among those that rely on as-a-service business models. Multibillion-dollar companies like Uber and Lyft aren’t successful because they transformed the car. They are successful because they mainstreamed mobility as a service. The same is true in the solar market, where third-party ownership unlocked a vast customer base that is interested in going solar but lacks the capital to do so.

Tapping the Potential of LaaS

LaaS is currently considered as an alternative, albeit superior, option to loans, capital leases and operating leases, due to its simpler accounting treatment as a service agreement— suggesting that the potential market is likely to be much larger than forecast if service providers shift to making LaaS their main go-to-market strategy.

So how can you get a piece of this pie?

According to a report from Rocky Mountain Institute (RMI), Lumens as a Service: How to Capture the Technology- Enabled Business Opportunity for Advanced Lighting in Commercial Buildings, service providers are in a position to drive a profitable paradigm shift in the business model for advanced lighting in commercial buildings, and will likely attract more customers by prioritizing the following considerations for their LaaS offerings:

- Ensure the LaaS service agreement specifies certain contractual terms, such as defining contractual roles and responsibilities, establishing payment and incentive capture, establishing termination rights and specifying other terms appropriate to ensuring service agreement characterization.

- Set a product specification strategy to meet customer requirements. RMI research indicates that LED retrofit kits paired with lighting sensors and controls are a top package for service providers to consider in commercial office retrofits. The system came out ahead of others based on a combination of first cost, (minimal) installation time, ongoing performance and straightforward installation that does not fundamentally change core building infrastructure and can easily be switched out.

- Target key trigger points in building life cycles, such as building purchases and investments, tenant fit-outs and new lease structuring.

- Distinguish between customer and tenant lease types only as helpful to balance ambitions to scale LaaS offerings with the needs of different customer segments and with the terms of different tenant leases.

What’s Next?

Even this simple customer/serviceprovider model is not frictionless, and more is needed to break open the market. As with anything new, a change in business mindset is required to fully appreciate and move forward with this new approach. Contracts are complicated. Financiers must navigate rigorous and costly accounting reviews. And success stories exist but have not yet been widely reported.

But LaaS is on its way to unlocking a large part of the $1 trillion energysavings potential of building efficiency retrofits, but it is just the tip of the iceberg for business model innovation in the building energy sector where other as-a-service offerings, such as heating and cooling as a service, have potential to drive new investment into better building performance.

Service providers, along with the real estate owners and tenants that you serve, operate in a tough market and the mere availability of economical clean energy technology is not enough to ensure widespread implementation. Because buildings consume 42 percent of primary energy in the United States, according to U.S. Energy Information Administration data, the financial stakes are high—and the climate stakes are even higher.

Continued innovation and market leadership will help service providers capture this burgeoning market and yield better buildings for owners, occupants and the environment—while offering exciting new revenue streams for service providers who are ready to lead, not just follow these market opportunities.